Accessing Your 1098-T Form (Wingspan > Account Portal)

Winthrop has partnered with TouchNet for the the access of 2025 1098-T tax statements.

Current students' tax forms are now available in the Account Portal via Wingspan Account Details card. Scroll down for instructions (images included).

The Account Portal should already be a familiar to students and authorized users,

as it the same portal used to make payments, view billing statements, set up payment plans, add authorized

users, and view account activity/history.

If you no longer have access to Wingspan, please complete this survey.

- If you do not remember your W#, leave that section blank. Ensure you provide your full birthdate.

- After completion of the survey, a SAS staff member will grant you, the student, access

as an authorized user in the TouchNet Account Portal. Please allow 1-3 business days

for your access to be established. Only students shall be granted access.

- You will be sent login instructions via the email you provide in the survey. Please ensure that you copy and paste the link into your web browser; clicking the link will redirect you to the SAS homepage.

- If you are a current student, do not complete this survey. Navigate to your Account Portal via Wingspan > Account Details

card to access your form.

About the 1098-T

For the specified calendar year (January 1 - December 31), the 1098-T form includes:

- Qualifying Tuition & Fees (Box 1)

- Qualifying fees: Library fee, environmental safety fee, course fees, new student fee

- NOT Qualifying: Student wellness fee/services, vehicle registration, late payment

fee, room & board, post office fee

- Grants & Scholarships (Box 5)

- Recorded payments

*It's important to note:If you enrolled in Spring term courses before Dec 31, the Tuition and Fees for that Spring term will be reflected in the 1098-T of the associated

calendar year, regardles of when the scholarships were applied. Please review Box 7 of your tax form carefully for this information*

To Access Your 1098-T Form:

- Navigate to Wingspan.

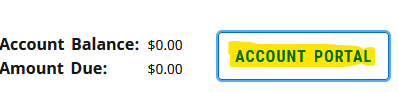

- Identify the Account Details card and click "Account Portal"

-

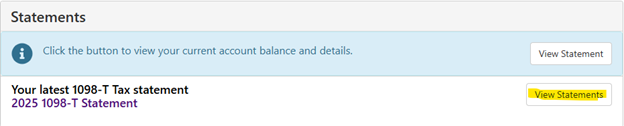

In the middle of the page, you should see the below. Click View Statements

-

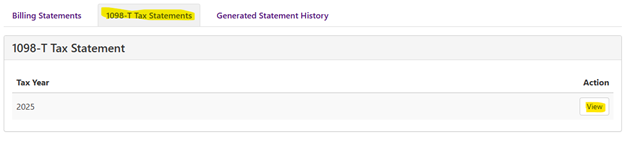

Click on the 1098-T Tax Statements tab and then click View under Action

- A pdf of the 1098-T will be produced for you to open. Please ensure that pdf pop-ups

are allowed.

- You may electronically save a PDF through the Print function. Print to: Save as PDF.

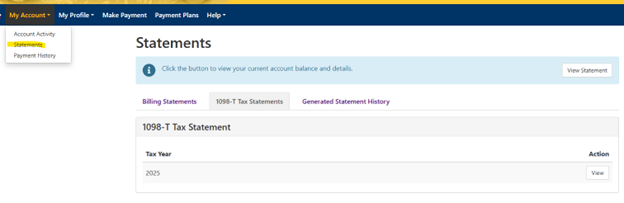

- The 1098-T can also be accessed through Statements under My Account: