Hennigar participated in the challenge as a class assignment for Finance 512.

Hennigar participated in the challenge as a class assignment for Finance 512.

ROCK HILL, SOUTH CAROLINA - Playing the stock market means you win some, lose some.

For Ross Hennigar, a December 2016 graduate of Winthrop University, you win.

Hennigar, a business administration graduate from Charleston, South Carolina, won

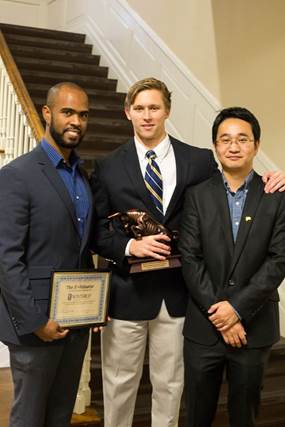

first place in The E-Valuator Asset Management (T.E.A.M.) University Challenge. He accepted the trophy and certificate in Thurmond with Philip Gibson and Jimmy Cheng, both assistant professors of finance at Winthrop.

"I got involved with it through my Finance 512 class," Hennigar said. "We had to enter

the contest for a semester assignment and choose the preferred stocks and bonds we

thought would do well. Whoever made the most of those funds won first prize."

The Finance 512 (FINC 512) course focuses on investments, including portfolio management and investment simulations.

The E-Valuator, one of the investment industry's fastest-growing analytical software programs, created

the challenge for universities that offer financial planning curriculums. Creators

hope to educate students on how asset management can affect their future clients'

portfolios.

Hennigar currently works at South State Bank.

For more information, contact Nicole Chisari, communications coordinator, at 803/323-2236 or chisarin@winthrop.edu.